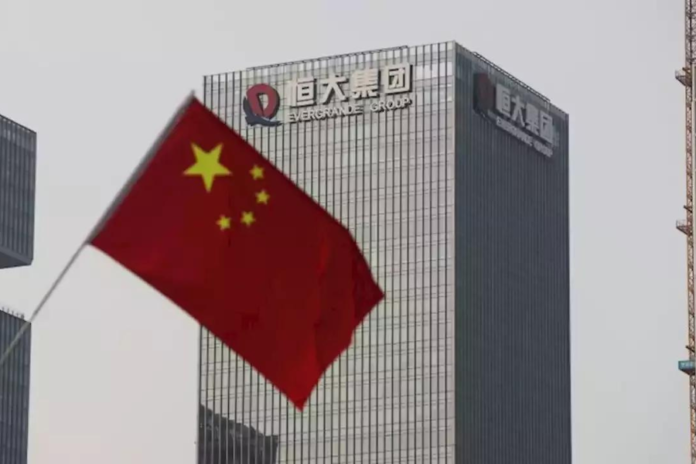

In one of the largest debt restructurings in history, troubled developer China Evergrande Group (3333.HK) has applied for bankruptcy protection in the United States as concern about China’s escalating real estate crisis and its effects on the country’s faltering economy deepens.

In an effort to boost flagging activity, China unexpectedly reduced several key interest rates earlier this week. On Monday, it is also expected to lower the rate on prime loans, but analysts say these actions have been too little, too late and that much more drastic action is required to stop the economy’s downward trend.

After experiencing a liquidity problem in the middle of 2021, Evergrande, once China’s top-selling developer, has evolved into the face of an enormous debt crisis in the country’s real estate market, which makes up around a quarter of the economy.

The developer has requested protection under Chapter 15 of the United States Bankruptcy Code, which protects foreign businesses that are going through restructuring from creditors who want to sue them or seize their assets there.

Although the action is viewed as procedural, it signals that the company’s reorganisation process, which has lasted more than a year and a half, is about to come to a close.

As its dollar notes are regulated by New York law, Evergrande stated in a filing on Friday that it will petition the U.S. court to recognise plans of arrangement under the offshore debt restructuring for Hong Kong and the British Virgin Islands.

“The application is a normal procedure for the offshore debt restructuring and does not involve (a) bankruptcy petition,” it stated in the filing, adding that it is moving on with its offshore debt restructuring.

The business suggested setting the hearing for Chapter 15 recognition for September 20.

Bonds, collateral, and buyback obligations make up the $31.7 billion in offshore debt restructuring for Evergrande. Later this month, it will hold a meeting with creditors to discuss its restructuring plan.

Since Evergrande got into problems, a number of Chinese real estate developers have fallen behind on their payments, leaving unfinished homes and unpaid suppliers, destroying customer confidence in the second-largest economy in the world. Over the past year, there has been a decline in real estate investment, sales, and new construction starts.

The property crisis has also stoked concerns about the financial system’s vulnerability to contagion risks, which might have a destabilising effect on an already fragile economy due to weak domestic and international demand, sluggish manufacturing output, and rising unemployment.

The No. 1 private developer in the nation, Country Garden (2007.HK), is the latest to warn of a stifling financial crunch after a major Chinese asset management missed payments deadlines on some investment products.

Investors in trust products offered by Zhongrong International Trust Co., a division of the asset manager, are outraged and have written letters of protest to regulators appealing for intervention after the trust company missed payments.

Nomura lowered its prediction for China’s growth this year on Friday, joining several of the biggest international brokerages in doing so. Although it has revised its prediction for China’s gross domestic product (GDP) growth this year from 5.1% to 4.6%, much of that growth may have occurred in the first quarter after harsh COVID limits were eased.

China is aiming for 5% growth this year, but more and more experts are expressing concern that it may fall short unless Beijing increases support measures.

Global markets have been shaken by China’s economic and real estate problems as well as by the lack of any tangible stimulus measures. The.MIAPJ0000PUS index of Asian shares saw a third consecutive week of losses. Friday saw a 1.2% decline in Chinese blue-chip stocks (.CSI300) and a 2.1% decline in Hong Kong’s Hang Seng Index (.HSI).

The Chinese securities regulator presented steps aimed at reviving the stock market on Friday and pledged to reduce trading costs and encourage share buybacks in an effort to bolster investor confidence.

However, the scale of Beijing’s assistance has so far disappointed the financial markets, leading some analysts to speculate that authorities may be hesitant to take a chance on adding to the debt mountain that was partly fueled by enormous stimulus in the past.

“To be sure, the economic downturn is putting a great deal of strain on financial sector balance sheets, and it does increase the risk of a messy policy mistake if officials don’t handle the situation with care. But we still think a full-blown financial crisis is a tail risk rather than a probable outcome,” Capital Economics said in a report.

In its quarterly report on the implementation of policy released this week, China’s central bank reaffirmed its commitment to adjusting and optimising property policies.

Since the middle of 2021, businesses responsible for 40% of Chinese home sales—mostly private property developers—have defaulted.

The second-largest private developer in China, Longfor Group (0960.HK), announced on Friday that it would work to increase profitability in response to shifting supply and demand.

The Beijing-based developer reported an increase in first-half core profit of 0.6% and stated that it will work to achieve positive cash flow once more this year while avoiding the taking on of further interest-bearing debt.

“The China property sector is like a black hole, so many developers have been dragged into it since two years ago after Evergrande,” Winner Zone Asset Management CEO and CIO Alan Luk told the media.

“The central government has yet to introduce (strong) measures because this is too large a hole to fill.”